Long-Term Cash Flow with Rentals: Your Complete Blueprint for Building Wealth

Introduction

Let's be real—there's nothing like the freedom of having your mortgage paid, bills covered, and cash flow coming in consistently, whether you're relaxing on the beach or sleeping soundly. Rental property investing is all about building wealth and achieving long-term cash flow through smart buying, disciplined management, and long-term thinking. This guide will help you create a solid rental portfolio that generates reliable, lasting income month after month, year after year.

What is Cash Flow in Rental Properties?

Cash flow is simply what's left over after all the bills are paid, making a thorough cash flow analysis essential for understanding the true profitability of a rental property. The basic formula is: Net Cash Flow = Rental Income – (Mortgage + Taxes + Insurance + Maintenance + Property Management + Vacancy Allowance). To get an accurate picture, include all cash inflows such as rental payments, pet fees, and other sources of rental property income, as well as every expense—monthly, annual, repair, maintenance, and turnover costs. Ignoring any of these can lead to negative cash flow.

Accurate cash flow analysis helps assess the financial performance and cash flow return of your investment property. For advanced evaluation, consider calculating the cap rate, which compares net operating income to the property's current market value. Maintaining positive cash flow is crucial for the overall financial health of your portfolio, and understanding tax benefits can further improve your net returns.

The Importance of Long-Term Cash Flow

Why chase long-term cash flow? Because it provides predictable, steady income every month, builds a growing foundation of wealth even while you sleep, and unlike flips or wholesales, rental income keeps coming consistently without drying up when the market slows down—long-term rentals are like real estate vending machines that keep generating cash flow as long as you maintain them. To learn more about building wealth through real estate investments long term, read The Best Strategies for Building Wealth Through Real Estate Investment.

Rental Property Types That Maximize Cash Flow

Single-Family Rentals (SFRs)

Low tenant turnover and easier financing. They also tend to attract long-term tenants, which helps maintain stable monthly rental income.

Duplexes & Triplexes

Live in one, rent out the others. Two to three units = more cash flow + diversification, providing a balanced mix of risk and reward.

Small Multifamily (2–4 Units)

Still qualifies for residential financing but provides bigger returns. These properties offer a great stepping stone for investors looking to grow their portfolios. See Multifamily vs. Single Family Investing: Which Is Right for You? to learn more about this type of property.

Large Multifamily (5+ Units)

High economies of scale — but you'll need commercial lending, professional management, and a game plan. Managing these properties often requires a more hands-on approach or hiring experienced property managers.

Mixed-Use Properties

Retail/residential hybrids can generate multiple streams of cash flow from a single property. This diversification can help buffer against market fluctuations in either sector.

Short-Term Rentals vs. Long-Term Rentals

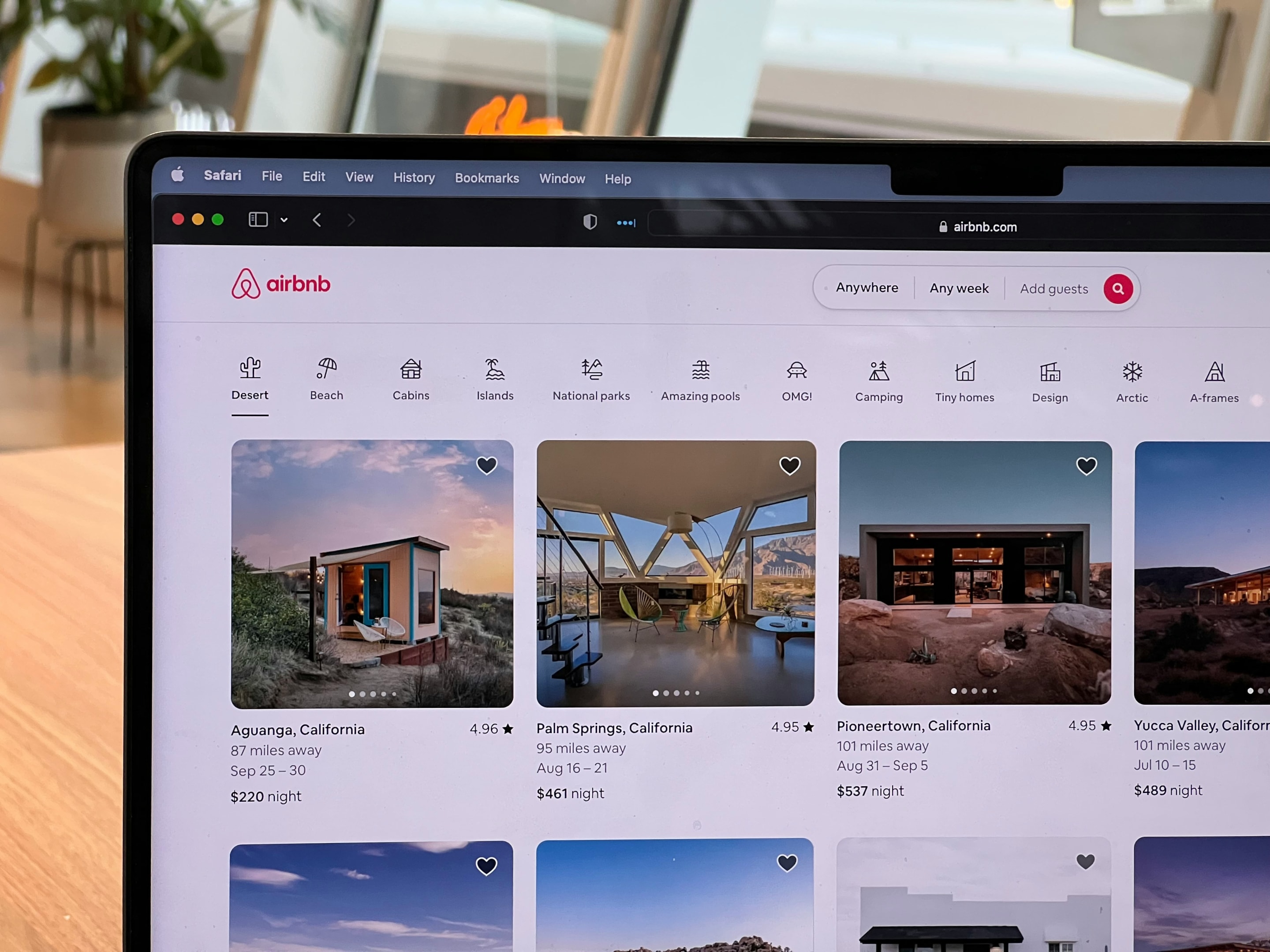

Short-Term Rentals (STRs): Think Airbnb or VRBO. They can generate two to three times the rent of a long-term lease but come with challenges like seasonal risk, frequent tenant turnovers, and increased regulations that require active management. See The Pros and Cons of Short Term Rentals: A Comprehensive Guide to learn more about getting into this niche.

Long-Term Rentals (LTRs): These offer steady, reliable income with less management effort, making them ideal for investors seeking passive income and consistent cash flow over time.

How to Calculate True Cash Flow

When calculating cash flow for your rental property, you need to include:

Maintenance reserves (5–10%)

Property management (8–12%)

Vacancy allowance (5–8%)

CapEx (long-term capital expenses like roof or HVAC)

Use tools like DealCheck, BiggerPockets Calculator, and Property Evaluator App to get accurate rental property cash flow projections. Make sure to use up-to-date data and run the numbers multiple times to ensure your real estate investment is sound and your cash flows are sustainable.

Characteristics of Good Cash Flow

Not all cash flow is created equal. For a rental property investment to truly pay off, you need to focus on generating good cash flow—the kind that keeps your finances healthy and stress low. Good cash flow means your rental income consistently exceeds all expenses, including mortgage payments, property taxes, insurance, maintenance, and property management fees. Many real estate investors use a simple benchmark: if your monthly rent leaves you with $100 to $200 per rental unit after all costs, you're in a solid position. Of course, what counts as "good" can vary depending on your market, purchase price, and overall real estate strategy.

Evaluating Rental Property Performance

To know if your rental property is truly working for you, you need to dig deeper than just the monthly rent check. Smart real estate investors evaluate performance using a few key metrics:

Net Operating Income (NOI): Subtract all gross operating expenses (like repairs, property management, and utilities) from your gross rental income. This shows how much your property actually earns before debt service.

Cash-on-Cash Return: This measures your annual cash flow as a percentage of the cash you've invested. It's a quick way to compare different rental property investments and see which ones are delivering the best bang for your buck.

Vacancy Rates & Rental Demand: High vacancy rates or weak rental demand can eat into your expected cash flow, so always factor these into your analysis.

Using a rental property calculator can make this process much easier, automating the math and helping you compare properties side by side. By regularly reviewing these numbers, you'll spot underperforming assets early and make smarter decisions about your real estate investments.

Finding the Right Market for Long-Term Rentals

Great cash flow isn't found everywhere. Look for markets with low median home prices, high rent-to-value ratios, strong job growth, and stable or rising property values that offer favorable current market value compared to potential rental income. Consulting real estate professionals can help you analyze these markets, identify the best real estate deals, and ensure long-term cash flow success.

Hot Markets in 2026:

Huntsville, AL

Cleveland, OH

San Antonio, TX

Ocala, FL

Des Moines, IA

Avoid areas with declining populations, high crime, or excessive landlord regulation. To see more hot areas for investing right now, read Experts Reveal the Best Place to Buy Investment Property for Maximum ROI.

Creative Financing for Rental Investors

Don't let lack of cash stop you from investing. Consider creative financing options like DSCR loans, which are based on rental income rather than your personal income, subject-to financing where you take over the seller's mortgage, private money from friends, family, or investors, and hard money loans that are high-interest and short-term, best suited for strategies like BRRRR. If you're new to investing or not familiar with these various financing methods, check out Creative Financing for Real Estate Investors: Top Tips to Save Money.

Managing Mortgage Payments

Your mortgage is likely your biggest monthly expense—and how you manage it can make or break your rental property's cash flow. Real estate investors should pay close attention to the interest rate, loan term, and monthly payments when financing a property.

Property Management Systems

DIY Pros:

Save money

Stay close to the process

DIY Cons:

You're on call 24/7

May slow down your ability to scale

Many investors choose to hire a property management company or property management companies to handle day-to-day operations, reducing stress and improving efficiency.

Effective tenant management is crucial for maintaining occupancy and reliable cash flow.

Top Tools:

Buildium

AppFolio

TenantCloud

These property management systems can also help track additional income sources, such as pet fees, to ensure accurate cash flow analysis.

Tax Strategies That Boost Net Cash Flow

Real estate offers significant tax advantages that can boost your rental property's profitability. Benefits like depreciation, bonus depreciation, 1031 exchanges, and cost segregation allow you to shelter income from taxes and accelerate deductions. Additionally, deductible rental property expenses such as operating costs and maintenance can further improve your net returns, turning a break-even property into a cash cow after taxes.

Keeping Units Occupied and Cash Flow Consistent

Vacancy is a major income killer, so minimizing it is crucial for maintaining consistent cash flow and maximizing monthly income. To avoid vacancies, thoroughly pre-screen tenants, renew leases 60–90 days in advance, offer incentives for early renewals, and keep rent competitive while adding value to your property.

Building an Emergency Reserve Plan

You'll need to set aside reserves to protect your investment, including a CapEx reserve of $200–$300 per month per property, a maintenance fund, and a vacancy reserve. A good rule of thumb is to allocate 15%–20% of your rent for these reserves to ensure your rental property remains financially stable and prepared for unexpected expenses.

Scaling Your Portfolio

Rental property investors and any real estate investor can scale their wealth by adding more investment properties over time. Start small, then snowball.

Use the BRRRR Method:

Buy undervalued

Rehab to increase value

Rent at market rate

Refinance to pull cash out

Repeat with a new deal

It's a rinse-and-repeat model for compounding returns.

Cash Flow vs. Appreciation: The Investor's Dilemma

Appreciation is a bonus, not the main goal. Prioritize cash flow first to ensure your investment remains financially strong and sustainable through market ups and downs. If property values increase, that's just an added benefit on top of steady cash flow returns.

Mistakes That Kill Long-Term Cash Flow

Underestimating expenses (especially repair costs and maintenance costs, which are often overlooked and can quickly lead to negative cash flow)

Overpaying for a property

Ignoring local tenant laws

Failing to screen tenants

Buying based on emotion, not numbers

Avoid these and your rentals will treat you well for decades.

Building a Successful Rental Property Business

Turning a single rental property into a thriving business takes more than luck—it's about strategy, discipline, and a commitment to continuous improvement. Successful real estate investors start by setting clear goals, whether that's achieving a certain level of cash flow, building positive cash flow streams, or targeting long-term appreciation.

Conclusion

Long-term cash flow from rentals offers a slow, steady, and powerful path to financial freedom. By starting with one profitable property and scaling wisely, your rental income can eventually replace your 9–5 job and support the lifestyle you desire. This approach not only builds wealth over time but also provides a reliable source of passive income that can weather market fluctuations. With careful management and strategic investment decisions, you can maximize income and create a sustainable financial future through rental property investing. To learn more about scaling your investment business, see Mastering the Basics of Real Estate Business: A Comprehensive Guide.